Chapter 4 : Maxxam’s on the Horizon

By Steve Ongerth - From the book, Redwood Uprising: Book 1

Download a free PDF version of this chapter.

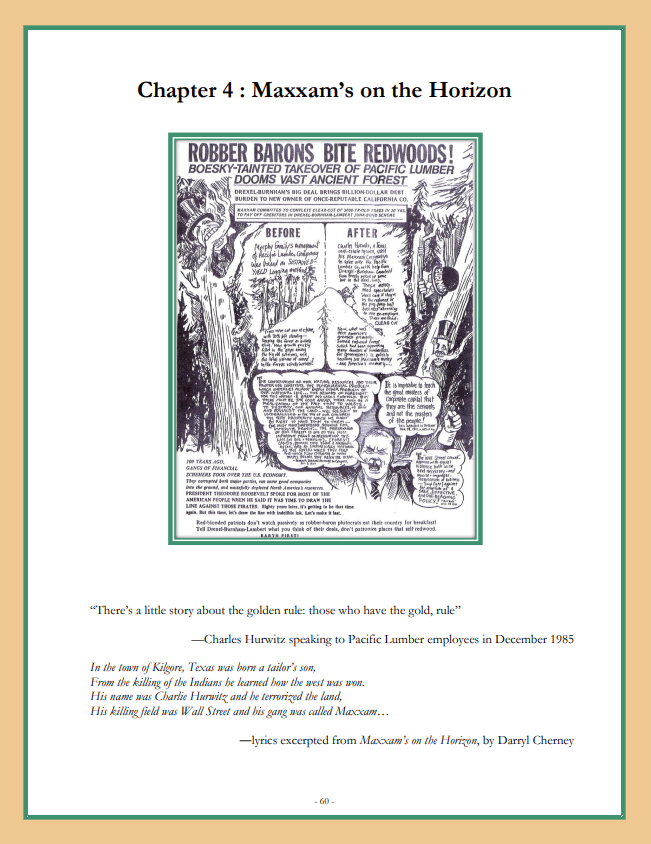

“There’s a little story about the golden rule: those who have the gold, rule”

—Charles Hurwitz speaking to Pacific Lumber employees in December 1985

In the town of Kilgore, Texas was born a tailor’s son,

From the killing of the Indians he learned how the west was won.

His name was Charlie Hurwitz and he terrorized the land,

His killing field was Wall Street and his gang was called Maxxam…—lyrics excerpted from Maxxam’s on the Horizon, by Darryl Cherney

By the fall of 1985, the Pacific Lumber Company (PL), based in southern Humboldt County, had existed for over 115 years and remained a virtual eye in the hurricane of class conflict, capitalist boom and bust, and ecological battles that raged throughout the Pacific Northwest. The company had been established in 1869 along with the company town of Forestville with the help of two Nevada venture capitalists named A. W. MacPhereson and Henry Wetherbee for a grand total of $750,000. [1] It was, in fact, the first foray by absentee owners into the redwood lumber industry of Humboldt County, predating even the California Redwood Company. Although it didn’t commence actual lumber operations until 1887, it grew quickly, and by the last decade of the 19th Century, it was the largest lumber company in the county. [2] By 1904, P-L owned 40,000 acres of timberland and its mill (“A”) operating on two ten-hour shifts, could produce 300,000 feet of cut lumber daily. By 1909, the construction of a second mill (“B”) increased the company’s productivity to a whopping 450,000 feet per day with one eight-hour shift working in both mills. The milling complex was one of the largest such facilities on the Pacific Coast. The town’s population increased from 454 in 1890 to over 3,000, and the company’s workforce numbered at least 2,000. [3]

There had been but one significant change in Pacific Lumber’s ownership over its history. In 1905, Maine lumberman Simon J. Murphy acquired the company with the help of east coast investors. [4] Upon acquiring the company he changed the name of the town to Scotia, in honor of his family’s roots in Nova Scotia. [5] It was under Murphy’s leadership that the company instituted its “welfare-capitalist” paternalism in a clear attempt to stave off attempts by the IWW (and other unions) to gain a foothold among Pacific Lumber’s employees. [6] In an effort to ensure that peace would reign supreme, the company closed its saloon, “an infamous whorehouse and gambling parlor” known as the “Green Goose”, in 1910, and replaced it with a bank. That establishment was later transformed into Bertain’s Laundry, which would at one time become the largest cleaning establishment in the county. [7] By the second decade of the 20th Century, Scotia was one of the nation’s most developed company towns, boasting of two churches, two banks, a saloon, a hospital, a schoolhouse, a library, a clubhouse, and a large company owned general store. It also included several cultural and social institutions, including four fraternal orders and a volunteer fire department. [8]

The IWW spared no vitriol at the obvious—and essentially overt—attempt by the employing class to steal their thunder, but the scheme worked. [9] The company wasn’t ever entirely free of dissenters, and there was at least one attempt at a wildcat in 1946 during the Great Strike. [10] Yet, the company remained nonunion throughout its history, resisting organizing attempts by the IWW, various AFL unions, and the IWA, even though ironically it was the threat of unionization that had inspired P-L to implement its benevolent dictatorship in the first place. [11] When Murphy’s grandson, Albert Stanwood Murphy, assumed the role of Chairman of the P-L board of directors, he carried on and enhanced his grandfather’s practices. [12]

While the Murphy family was anti-union, they were far more conservation minded than most and they instilled that ethic into Pacific Lumber’s logging practices. This didn’t happen overnight of course. It took some prodding from Save the Redwoods League in the 1920s to convince them to consider the preservation of old growth redwoods, but unlike most timber companies, P-L embraced sustainable logging. Under the direction of Albert S. Murphy, who inherited the company in 1931, Pacific Lumber introduced selective logging practices as opposed to clear cutting, and limited old growth logging to no more than 70 per cent of inventory, and the company continued the practice from then on. The rest of the timber industry scoffed at P-L’s methods, but the environmental movement hailed them as revolutionary. [13] It bucked the economic trends of capital, adopting one of the most sustainable logging practices in all of the Pacific Northwest, so that by 1985, it possessed the largest inventory of privately owned old growth redwood left in the world. [14] Every year it would sell approximately 40 to 50 million board feet of redwood lumber without depleting its standing timber resources, and as time passed, those vast stands of old growth redwoods became the envy of the other companies. Bud McCrary, vice president of Big Creek Lumber in Santa Cruz in 1985 declared, “Pacific Lumber has done an excellent job. Their concept of conservative forest management has paid off for them…They’re the guys in the white hats in the logging business. They’ve been a long term company with high ideals.” [15]

Pacific Lumber also eschewed short-term profit in favor of long term economic stability. In 1955, when logging and mill related deaths were at a major peak, and often accepted as the cost (though, of course, not to the employing class) of doing business, the company adjusted its production practices which resulted in an 80 to 90 percent reduction in untimely fatalities. After a major flood in Humboldt County in 1964, P-L declined to claim assessed valuations. They could have legally done this, but in doing so would have deprived the county’s general fund of much needed revenue. Certainly, P-L’s sustainable logging meant less short-term profit, but by all estimations yielded better long-term gain. A marked contrast could be seen, for example, in the company’s logging in the Mattole and Eel River watersheds which, by contrast to the other logging companies in the same area were as different as night and day. [16] The company applied this philosophy to its workforce as well. They rented the houses in Scotia to its employees at below market rates and maintained a “no layoff” policy during economic downturns in the lumber market. [17]

Pacific Lumber was an icon of stability, not at all like Georgia-Pacific, Louisiana-Pacific, Simpson, or Boise-Cascade. Although Pacific Lumber workers also lived in nearby towns, including Arcata, Carlotta, Eureka, Ferndale, Fortuna, Hydesville, Rio Dell, the majority of the workers desired to live in Scotia. Albert Murphy’s son, Stanwood A. Murphy, described the benefits of life in Scotia in 1971 thusly:

“After (a new employee) has put in ninety days on his mill job, he can get on the list to move into Scotia, where a comfortable one bedroom company bungalow, with a garden and a lawn on a quiet residential street rents from under $60 a month (in 1971). Water and sewage and garbage removal are free. Every five to seven years, the company will repaint his house, inside and out, free. As he moves up in the company, he can move to a large house. He has good accident and health coverage, and a choice of a pension plan or an investment program…If his son or daughter qualifies for a four-year-college, he or she will receive a thousand-dollar scholarship from the company.

“If he chooses to reject the moderate’s course, if he is frequently absent from work, guilty of drunkenness, fighting or reckless driving, if he is an offensive neighbor, mistreats his family, or gets himself heavily into debt, he will feel the pull of the company reins. A man who has applied for a house in Scotia may be kept waiting six months, a year, or forever, because of his behavior; a man living in a company house, who fails to give the yard a minimum of care, may find a company garden crew coming by to cut his lawn and weed his flowers for him, a service for which he will be billed. The pressure is subtle, but firm.

“…Pacific Lumber deducts eighty-five dollars a month from his check for rent, water and garbage. He pays no personal property tax. When something goes wrong with his household plumbing, if one of the kids breaks a window or the electricity goes out...just calls the company plumbing shop or the carpentry shop or the electrical shop, a man is sent out promptly, and there is no bill...

“We’re a paternalistic company. I know that’s a dirty word, but it’s accurate. We lose money on the town. We figure it’s worth it, to keep a good crew here.” [18]

Virtually every board foot composing Scotia’s more than 272 houses, and each timber in its hospital, all of the siding enclosing the Scotia Inn, and all of the logs that provided the columns for its elaborate Winema Theater was made of redwood harvested from its holdings and milled in its enormous mill complex. The company boasted of 300 acres of log ponds and debarking equipment, and stacks of drying lumber a mile long and a quarter mile wide. [19]

* * * * *

For a time, it seemed, the Murphy dynasty were as unchanging and as steadfastly enduring as the ancient redwoods themselves. Albert Stanwood Murphy ran the company until 1961 and was succeeded by his son, Stanwood A. Murphy Sr. However, in 1972, Stanwood succumbed to a heart attack and died in Scotia in the home of one of Pacific Lumber’s workers. Although Stanwood’s sons Stanwood Murphy Jr., affectionately known as “Woody”, born in 1951, and his younger brother Warren, born in 1953, were considered scions of the dynasty, ironically under P-L’s paternalistic practices, they were also considered far too young to grab hold of its reins. Both of Stanwood’s sons had been encouraged, by their father, to work their way up through the ranks of the company in order to prove their worth, and—though they were literally the favored sons with an almost guaranteed inside track—their father’s untimely death happened while they were far from the proverbial finish line. [20] Instead, the board of directors promoted two higher seniority executives, in succession, to follow Stanwood Murphy. Then they hired the third, company accountant Gene Elam, from an outside source, Arthur Young. [21] Their choice had been partly motivated by a desire to diversify the company’s assets in order to ensure long term stability. Given Stanwood’s death, the loss of a Murphy at the helm—at least for a time—raised hitherto unknown concerns about the future of the venerable lumber concern. [22]

Under Elam’s watch, Pacific Lumber’s timber production fared very well, and yet it also continued to follow the Murphys’ practices of sustainable forestry. By the fall of 1985, the company owned approximately 193,000 acres of timberlands in Northern California. Almost 145,000 acres of that was redwood, and the remainder was Douglas fir. Most estimates suggested that at least 12,000 acres of old growth redwood were owned by P-L, and that represented 40 percent of all remaining old growth at the time. P-L carried timberlands on its books at cost—$34 million, or $176 per acre. The land it owned, however, was worth $25,000 per acre of old growth, and $1,000 per acre for new growth. [23] Of its lumber production, the split was 30 percent non-redwood; 35 percent old-growth redwood; and 35 percent residual or younger growth redwood at the time. [24] The 800 P-L employed in Scotia were but a fraction of its entire workforce. [25]

Scotia seemed like an island that had managed to escape the modern hyper capitalist timber industry. At one time there had been as many as 200 company towns located throughout the American west, but even as early as 1980, Scotia had become a living relic. [26] Even in the days when it wasn’t, Scotia was unique, representing a genuinely happy kingdom in contrast to the slave labor conditions that existed in many other company towns. [27] After the closing of the last working timber mill in McCloud, California at the foot of Mt. Shasta in Siskiyou County in 1979 by Champion International, Scotia became the last existing lumber company owned company town in the United States of America. A workforce of nearly 800 worked at the Scotia mill, a third of who lived in the town with their families. [28] In addition, all of the support work, from the local grocery market, to the street and park maintenance, to the blacksmiths (whose job it was to forge logging and milling tools), to the janitors and office staff were employed by P-L. [29] Still, as the IWW had tried to point out, much of this serenity was an illusion, an outlier of an exception that went against the rule of the realities of Corporate Timber, and as it turned out, P-L’s desire to preserve its isolation would ultimately lead to its undoing.

Elam did diversify the company in the early 1970s, but only to a point. He began the process of reducing the company’s huge cash reserves (which Stanwood Murphy Sr. had believed made the company prone to attract a potential corporate raider), by investing them in a huge pension fund for the company’s employees he helped create. [30] By 1985, P-L had become the leading producer of both gas and plasma cutting and welding equipment. This portion of the business contributed 58 percent of P-L sales and 46 percent of its operating income in 1984. Lumber accounted for only 28 percent of the company’s sales that year, but 50 percent of its net income. [31] The company’s timberland was worth $1 billion, according to some estimates; its cutting and welding division was worth $250 million. Additionally P-L owned 3,400 acres of Sacramento Valley farmland, a downtown San Francisco headquarters building, three sawmills (including Mills A and B in Scotia as well as another in Fortuna), and 274 homes. [32] In spite of Elam’s best efforts, however the company was still very “cash rich”, its pension fund overfunded by approximately $60 million, and its numerous assets could be quickly liquidated in a hostile takeover. [33]

Furthermore, in 1975 the owners had made what seemed like an innocuous decision to list the company on the New York Stock Exchange. In 1984, P-L earned $44 million on revenues of $281 million. [34] As a result, the company paid out a large chunk of its value to stockholders. In 1984, dividends equaled 61 percent of net income. [35] To prevent a takeover, none of its shareholders, including the Murphy’s family members owned more than five percent of its stock. [36] Analysts estimated the value of the company’s assets at $50 to $70 per share [37], but due to its sustainable forestry practices and its paternalistic policies, it traded at only $29 in the fall of 1985. [38] Pacific Lumber (or “PALCO” as it came to be known) was an ideal business if one assumed that businesses described in economic textbooks actually existed. In the real world however, under the increasingly speculation oriented phase of capitalism ushered in by the economic policies of Ronald Reagan and Margaret Thatcher, Pacific Lumber was a plum ripe for the picking. [39] Still Scotia and Pacific Lumber carried on, much as they had before, somehow seemingly protected from the pressures of the outside world, much like Rivendell in J.R.R. Tokein;s fictional world of Middle Earth.

* * * * *

All of that would come to an abrupt end in the middle of autumn of 1985. Throughout that summer there had been hints that somebody was taking an unusually strong interest in Pacific Lumber, but the clues were so subtle, so hidden that they escaped the notice of the company’s ten member board of directors—which included Suzanne Beaver (Stanwood Murphy’s widow), Gene Elam, and the latter’s predecessor, Robert Hoover, whose duties included monitoring such activity. This was often difficult, because even then there were thousands of trades made daily, and even a single buyer taking a particular interest in one company might not have any major significance. There was no way that the stewards of the Murphy Dynasty could know that a single buyer who purchased just under a million shares of the company—just below the five percent maximum threshold established by the recently passed Hart-Scott-Rodino act—was anything more than a typical player in the rustle and bustle of the New York and Pacific Stock Exchanges. The casinos of Western Capitalism were a fair distance away from the everyday concerns of the Pacific Lumber Company and its relatively happy kingdom. Then again, it might have all of the significance in the world, but there was no way to be sure. [40]

Then, in the last days of September, rumors began to circulate much more heavily among the shareholders and workers of Pacific Lumber and the residents of Humboldt County that someone—a mysterious financier from back east—was making a serious play for the company. Normally Pacific Lumber’s stock traded at about 25,000 shares daily, but on Monday, September 25, 1985, 100,000 shares changed hands. Usually the value of the shares fluctuated by no more than a dollar per day [41], but the next day the stock rose from $29 per share to $33, and reached $38 the following Monday, September 30, at an unheard of volume of 350,000 shares. [42] Most of the company’s stock was owned by small shareholders and had been in their families for many years. None of them were likely to be engaging in such unusual activity. It was therefore not surprising at all that the sudden peak in activity set off alarm bells. [43] One of the P-L board of directors’ primary duties was to ferret out and investigate such rumblings should they prove to be more than just static, but what they didn’t know was that those responsible for the unusual trades had done their homework well in advance and knew very well how to mask their activity.

Then, quite out of the blue, the man who had the answer sought out the one most responsible for asking the question. Early on the morning of September 30, 1985, just after 5:30 AM, a man named Charles E. Hurwitz contacted Pacific Lumber President and Board Chair Gene Elam revealing his plans to purchase the old lumber company for $746 million. [44] He was the CEO of a New York based mortgage firm known as the Maxxam Group and he had already acquired 994,000 shares of Pacific Lumber’s common stock (just under 5 percent of the total) and was proposing to purchase the rest. [45] He was offering $36 per share for the company’s estimated 21 million shares of common stock, for a total of $823 million. [46] Hurwitz declared Maxxam would finance the purchase offer with $700 million in privately placed debt and bank financing with the rest to be provided from general corporate funds. [47] $400 million of the debt securities would be placed by Drexel Burnham Lambert (DBL), Owned by one Michael Milken, who was acting as the dealer manager of the tender offer, while Irving Trust Company would lend up to $300 million. [48] Meanwhile, Maxxam announced that it was boosting its stake in another publically traded firm, UNC Resources, to 19 percent and was seeking regulatory approval to acquire as much as 51 percent of that company, perhaps in order to use its $102 million in cash reserves to acquire P-L. [49] Elam, acting on advice from the P-L board’s corporate legal counsel Ed Beck publically declared that “he could not comment” on the rumor’s veracity, but privately he knew it was the cold, hard truth. [50] Demonstrating that he was quite serious, Hurwitz upped his offer to $38.50 per share on October 1. [51]

He may have been a man of mystery to the people of Scotia, but in the world of high finance Charles Hurwitz was well known for hostile takeovers and greenmail. [52] He was not an old man, in fact he was only 45, but he had already earned a reputation for being one of the most ruthless speculators and unscrupulous businessmen in the nation, skilled at using millions of dollars to control billions in corporate assets. He was an expert raider and greenmailer, ruthless and unyielding, “adept at acquiring a minority stake in a company and then using it to gain control or to force the company to buyout his position for a profit,” and like Harry Merlo, not adverse to skirting the boundaries of the law when it suited him. [53] Even among the capitalist class, Hurwitz and his ilk had been considered extreme, perhaps best personified by the character of Gordon Gekko in the 1987 Oliver Stone movie Wall Street. There was some speculation by Standard & Poor’s Stock Reports, that he had targeted Pacific Lumber because acquiring it would have diversified Maxxam’s portfolio, allowing him to avoid filing with the Securities and Exchange Commission (SEC) as an investment company, which carried with it a much more stringent set of regulations. [54] However, Maxxam was just a piece of Hurwitz’s vast financial empire, which was built on three key investment bases that were intertwined in a complex financial ownership arrangement designed to shelter and protect assets and avoid scrutiny. At the time, Maxxam was the name of his real estate company based in New York City, while his other two divisions were Federated Development Company in Houston and MCO Holdings in Los Angeles. His business holdings included 13 shopping centers in western New York State, a large savings and loan in Texas, a large resort in Puerto Rico, and much more. [55]

Hurwitz had built this empire quickly and mercilessly. He was a self-described farm boy from eastern Texas, but at age 24 he opened his first brokerage, a mutual fund called Summit Group, on Wall Street and created a $4 billion oil, real estate, and financial empire. In 1971, while managing Summit, he was charged with violating antifraud regulations in connection with stock trading. The matter was resolved in his favor when he signed a consent decree without admitting guilt. Seven years later, however, after an insurance company he owned collapsed, he was charged with mismanagement and fraud by government regulators. Those charges were also dropped. [56]

Since he had already earned a reputation as a calculating and brutal wheeler and dealer, he began to keep a reclusive profile, rarely granting interviews or making public appearances. But, while Hurwitz may have personally been incommunicado, he was as active as ever in the business world. In 1978, he began accumulating stock in the L.A. based McCulloch Corporation, which had began as a chainsaw company but had long since diversified its financial activities. At that time, the company was drowning in debt and hamstrung by litigation. Hurwitz acquired 13 percent of its shares, valued at a total of $8 million. In spite of heavy opposition from McCulloch’s old guard, Hurwitz successfully placed two of his lieutenants, Teledyne cofounder George Kozmetsky and New York attorney Ezra Levin on its board of directors. He then bided his time until 1980, engineering a coup and taking over its chairmanship. [57] According to one McCulloch manager, “Charles came across as so warm and caring that it took almost two years to realize we’d lost control.” [58]

With the return to neoclassical laissez faire capitalism in the 1980s, extremists like Merlo and Hurwitz were no longer as reviled among their class, and even though they alarmed their fellow capitalists by pushing the envelope, the latter secretly welcomed the financial benefits such activity brought about. Within this increasingly dog-eat-dog atmosphere, Hurwitz was as busy as ever. Under his leadership, the McCulloch board’s first act was the elimination of monthly management committee meetings, the termination of management’s costly stock-option plan, and the sale of its 14 jets. Hurwitz then spun off McCulloch’s energy division, renaming it MCO Resources, and sold the remainder, including its coal properties, for a $115 million during the energy boom at the end of the Carter Administration. Then, in 1982, Hurwitz used McCulloch, in which he controlled 60 percent of the company’s shares, as a vehicle to capture Simplicity Pattern Company, a sewing pattern producer for $48 million. Like Pacific Lumber, Simplicity was cash-rich, with a sizable pension plan. [59] Hurwitz took his profit by reducing the employees’ annual pension fund allocation—which had remained unchanged for 37 years—from $10,000 to $6,000, even after promising to leave it untouched. [60] He then offloaded the Pattern Division to another company, Triton Group, renaming the remainder Maxxam in 1984. [61] Hurwitz retained 11 percent of the old Simplicity Pattern company and transformed Maxxam into the real estate investment company it was now known as through additional acquisitions. [62]

Beginning in 1983, Hurwitz fought a decade long battle with the southern California town of Rancho Mirage. Located east of Palm Springs, it was known as “the Playground of Presidents”, and was one of the wealthiest municipalities in the United States. Hurwitz attempted to finance the construction of a Ritz Carlton Hotel and estate housing on the lambing grounds of the endangered bighorn sheep that lay within the city limits. The bighorn were well loved and had been chosen as the town’s official emblem, even to the point of being embossed on the town’s business cards. Unbeknownst to his fellow shareholders, Hurwitz used worthless collateral from another one of his companies to finance the purchase of the land. [63] Hurwitz initially had the support of former president Gerald Ford and rubber-fortune heir Leonard Firestone as partners. [64] The residents of Rancho Mirage on the other hand, many of them famous actors and entertainers, including Frank Sinatra and Susan Marx (Harpo’s widow), were incensed, and fought a long a bitter battle with the Texas financier. They overwhelmingly passed a ballot initiative to stop the construction of the hotel and housing, in reaction to which Hurwitz sued the city. [65] In a moment of fearfulness, the city council caved in to Hurwitz, anxious that the city might go bankrupt in a protracted legal battle with the financier, who seemingly had deep pockets. [66] Ironically, Hurwitz’s fellow shareholders eventually sued him—in 1992—for $30 million for misrepresenting the nature of the collateral, which turned out to be worthless, but that time the hotel had been built and the lambing ground destroyed. [67]

Hurwitz was far from finished, however. In 1984, he threatened a hostile takeover of Castle & Cooke, while the latter’s management was mired in a failed attempt to acquire Dr. Pepper. [68] Hurwitz acquired 11.8 percent of the company’s stock, and, in an act of greenmail, forced the shareholders to buy back the stock he had purchased at $70.8 million, a 25 percent premium above the market price. [69] Hurwitz walked away with approximately $9 million in profit for a mere three months’ effort, and left an empty shell in his wake. The now emaciated Castle & Cooke merged with Flexi-Van Corporation in early 1985. [70]

Signs everywhere pointed to Hurwitz engaging in similar machinations to acquire P-L, and he was evidently prepared for every eventuality. Though the venerable lumber company was a juicy target for a takeover, its directors had thought they had taken appropriate counter measures, including incorporating various protective clauses in the company’s bylaws—such as a requirement for 80 percent shareholder approval of a sale of the company—to ensure that it was still a more difficult takeover opportunity than most. [71] Hurwitz had purchased five percent of the company’s common stock already, but he could not immediately acquire more even if he had the money, because in doing so he would have violated Hart-Scott-Rodino and would also have to receive permission from a supermajority of the P-L’s stockholders. [72] Clark Bowen, vice president and resident manager of Shearson Lehman / American Express in Eureka, was certain that Maxxam was driving up P-L’s stock in another greenmail attempt, but in retrospect, that may have merely been Hurwitz’s fallback position. The Texas raider had much bigger plans for Pacific Lumber. On Thursday, October 17, two weeks after the initial spike, profit-takers drove the P-L stock to a high of $40 per share before closing at $39 at the conclusion of the day’s trading. [73] Even the New York Stock Exchange’s normally permissive watchdogs took notice of the activity and initiated an investigation into the unusually heavy trading that took place and by their own estimations “uncovered significant evidence of insider trading” and stock parking, but chose not to pursue the matter further. [74]

That Hurwitz had silent partners in his takeover efforts was evident, the only questions were how many there were and their identities. In time, it would be revealed that one of these shadowy allies was Boyd Jeffries, chair of the Los Angeles brokerage firm Jefferies Group, Inc., who later plead guilty to parking stock for the former. [75] Hurwitz instructed Jefferies, to purchase $40 million worth of P-L stock, worth about 2.3 percent of the company’s total value, to avoid violation of Hart-Scott-Rodino. [76] On September 27, P-L stock was trading at $34 a share, but Jeffries sold his shares of the stock to MCO Holding Company for an extremely charitable amount of $29.10 a share, which, considering the volume, was one of the most “philanthropic stock sales ever seen on Wall Street.” [77] Evidently, Jeffries’s purchase had been designed to hold the stock for Hurwitz, after the latter had reached the Hart-Scott-Rodino threshold [78] and was anxious to acquire P-L. [79] Hurwitz had gambled, however, on the board of directors being unaware of the 80 percent supermajority requirement (since P-L had never seriously been the target of a takeover during their tenure), hoping they would instead assume that only a simple majority was needed. [80] Hurwitz had guessed correctly, but he had an unexpected complication.

Another mysterious figure involved in Maxxam’s stealthy acquisition of Pacific Lumber’s stock was none other than the infamous Wall Street speculator Ivan Boesky. Allegedly unbeknownst to Hurwitz at first, DBL’s Michael Milken instructed Ivan Boesky to also purchase nearly 5 percent of P-L’s stock, which he did just prior to Hurwitz making his initial move. Boesky eventually made a tidy profit of $950,000 from this venture, and it explained the initial spike in P-L’s trading activity. [81] This was Milken’s attempt to hedge his bets, just in case Maxxam was unsuccessful in its attempts to convince the P-L board to agree to its tender offer, and it also theoretically shielded DBL from charges of stock parking. [82] Boesky, who would later be implicated for insider trading that netted him several million dollars, and reveal all of these connections to the SEC was to Milken as Jefferies was to Hurwitz. [83] Milken’s and Boesky’s machinations almost doomed the deal however, because other Wall Street sharks unconnected to the collusion had sensed an opportunity and jumped into the fray on Thursday, September 26 threatening to drive the price of P-L’s stock up beyond Hurwitz’s planned tender offer. Ironically, Hurwitz was saved by Mother Nature, of all things, in the form of Hurricane Gloria which shut down the stock market on Friday, September 27. None of this information had been uncovered by the P-L directors either. When trading resumed on Monday, Hurwitz made his move. [84]

* * * * *

Hurwitz also apparently had silent partners within Pacific Lumber, or at the very least he could count on specific key personnel to assist him in these efforts. One of his most willing collaborators was an ambitious up and coming executive by the name of John Campbell. In 1967, Campbell, a native of Australia, had married Cindy Carpenter, the daughter of one of the current P-L directors, Ed Carpenter, who had also been Stanwood Murphy Senior’s best friend. Campbell had always been considered ambitious and Machiavellian to the point of ruthlessness, and he had a much different vision for the future of the company than the Murphys. Indeed, Campbell, who had been trained in Australia as a banker, had much more in common with Harry Merlo than Stanwood Murphy Sr. He considered the conservative P-L logging practices, including its prohibition on clearcutting, as an embarrassment, since it greatly underutilized the company’s profit potential. Due to his family connections, however, Campbell had been regarded as almost being one of the Murphys himself and, like Woody and Warren, had been put on the same management track. By 1984 he had climbed the company management ladder to the point where he was second in command in the management of P-L’s production chain in Scotia, under the direction of executive vice president of lumber production, Warren Flinchpaugh. [85]

Flinchpaugh, by contrast, was very much a true believer in the Murphy’s traditional management and production policies, to the point where he butted heads with Gene Elam, sometimes even withholding production figures from the P-L president in San Francisco. According to existing company practices, however, even though Elam may have been the president, it was the production boss in Scotia who actually set the pace. Campbell knew this and planted the suggestion in Elam’s mind that Flinchpaugh had looked the other way when one of the gyppos that contracted with P-L had been double dipping. Flinchpaugh denied the accusations, but Elam took them at face value without conducting a thorough investigation, and after pressuring his subordinate for several months, the now maligned executive applied for early retirement. No doubt the innuendo and finger pointing, some of it possibly stoked by John Campbell, helped influence Flinchpaugh’s decision, but Elam had already hoped to replace his underling in favor of one more communicative. [86]

Campbell was now in charge and he wasted no time in proposing changes. He had intended to ramp up annual lumber harvesting from 130 million bf to 170 million, but, he needed the P-L board’s approval for such a radical departure from P-L’s existing practices. Even though Elam had welcomed the newly appointed executive vice president’s ambition and production oriented management philosophy, the P-L president and the rest of the board were averse to abandoning the Murphys’ logging policies. Campbell hoped to make them see otherwise, however, and called upon the services of the company’s forester manager Robert Stephens to make his case before the P-L board during their September 1985 meeting. Ironically, Stephens had usually been charged with defending the company’s sustainable logging practices and progressive environmental policy before critics many times and had often performed beautifully. [87]

Stephens was nothing if he was not a company man, but he was more than willing to do Campbell’s bidding. But, when questioned by the board, especially director Mike Hollern of Oregon, who was also a true believer in the Murphy philosophy and quite knowledgeable on forestry issues himself, Stephens could not offer any substantive proof that the liquidation logging practices currently in trend at the time would meet the long term conditions that the existing P-L practices offered. The directors tore Stephens’s arguments to shreds. Campbell watched the affair stone-faced, and then later roundly excoriated his underling for embarrassing him in front of them. Expediently, however, Campbell contacted Elam and informed his superior that Stephens had been thoroughly chastised for his incompetence, all the while secretly still hoping to implement his more aggressive, profit-oriented logging philosophy. [88]

* * * * *

By this time Woody and Warren Murphy had come of age and were in their early 30s, but neither brother was in any position to resist the unfolding drama. The elder Murphy had always desired to work for Pacific Lumber and had truly learned the business by taking on one lumber production assignment after the next. He eventually found his way to the P-L corporate office in San Francisco to work in sales and attend college to learn corporate law and business administration. [89] Many of those close to P-L had originally assumed that one day, he would be the next president of Pacific Lumber, but he didn’t turn out to be what most would call “executive material”, even in the anachronistic company that employed him. Woody was always a logger at heart and he decided—against the better judgment of his father—to return to the woods, which he did for a time, running one of the P-L road crews for the better part of a decade. Less than a year before Maxxam’s attempted merger, after an ill-fated exchange with one of his superiors, he complained to John Campbell, hoping to invoke his family name. Instead, Campbell fired him and Murphy earned the dubious honor of being the first member of his family ever to be fired from the dynasty. [90] In spite of this, he continued to hold one percent of P-L’s stock and remained fiercely loyal to the company, even though he started his own gyppo firm, Woody Murphy Logging and Construction in Field’s Landing north of Rio Dell. “You take (PL) away from me and it’s like taking a vital organ out of me,” he declared in response to Maxxam’s threat. [91]

Woody decided to act, and he called upon another long time scion of Scotia and childhood friend, William Bertain. Bertain was the youngest of ten children of the last man to own the town laundromat that bore his family name. He was also something of a contradiction. Like Murphy, he had grown up in Scotia, but had chosen a career in law, originally attempting to practice in San Francisco, but having returned to Humboldt County after feeling like a fish out of water in a corporate office. He was a staunch and fairly conservative Republican, similar in temperament to Barry Goldwater or Ronald Reagan, and yet he had a reputation for fighting for the underdog, and he was personally horrified by the possibility of an outsider from Texas using Wall Street money to destroy his childhood home. He had successfully fought against the location of a sewage plant on Humboldt Bay, but he was hardly “anti-business”, having helped Woody get his own startup on proper legal footing the previous year. Bertain was not a specialist in securities law and informed his client that he needed to research their options before taking action. Woody requested that his younger brother, Warren, be included in any legal action they took, but Bertain disabused of the notion explaining that his younger brother was in an even more difficult position than himself. [92]

* * * * *

Indeed, he was. Warren Murphy had also traveled the path dictated by his father. He looked and acted the part of a corporate executive, however, and had been appointed P-L’s manager of lumber operations a few months before Hurwitz’s initial foray. Like his brother, he too owned one percent of the company’s stock. [93] If his brother wasn’t appointed P-L president, Warren almost assuredly eventually would be—unless Hurwitz had his way. [94] Warren worked very closely with John Campbell, his immediate supervisor, who had also been a longtime friend. In Warren’s mind, if he was “Michael Corleone”, and his older brother, “Sonny”, then Campbell would almost assuredly be “Tom Hagen”, the family “consigliere”, and in general, the ambitious executive ostensibly played the part. Warren had gained limited bits of information from his mother, but her understanding of the complex and byzantine drama that was unfolding was limited at best. His instinct told him to charge into battle, but he held back until various potential “White Knights”—potential alternate suitors who could potentially outbid Hurwitz—courted by the board of directors began showing up. At this point, the younger Murphy decided to act and contacted Elam and Hoover by phone, in a conference call that that was witnessed by John Campbell. [95] Elam instructed Murphy, “in no uncertain terms,” to stay out of the way. [96] At this point, Campbell suggested to Murphy that the fate of the company was in the hands of the directors. Murphy, still thinking that the executive was a trustworthy ally, believed him. [97]

* * * * *

The P-L board of directors, including Gene Elam, had indeed initially appeared steadfastly opposed to Maxxam’s advances. Pacific Lumber had shielded itself, or so they thought, from hostile takeovers in 1981 by adopting several limiting provisions, including staggered terms for directors and a requirement that the board consider “all relevant factors, including social, legal, environmental, and economic effects” when faced with a merger proposal or tender offer. [98] On October 9, they not only rejected Hurwitz’s offer, they filed a lawsuit against Maxxam, charging that Hurwitz was “a notorious takeover artist…(whose) background demonstrates a conspicuous absence of integrity, competence, and fitness necessary to control or manage (a firm such as Pacific Lumber).” [99] They also charged that Maxxam’s offer of $38.50 per share was “inadequate”, and they could cite as proof the opinions of several respected financial analysts. For example, Christopher Charles of Wolf Hansen & Co. estimated that P-L could sell in the high 40s. [100] Then they contacted a number of “white knights”. Speaking for his fellow directors, Elam declared,

“The board was unanimous in rejecting this inadequate bid by the Maxxam interests and is determined not to allow the great company to be acquired at in inadequate price…It seems inconceivable to me that a company and its stockholders can be subjected to a disruptive and possibly (fraudulent) tender offer where the financing is not secured and there’s no assurance that the money will ever be there.” [101]

Reaction among the Pacific Lumber workers and townsfolk of Scotia was apprehensive, but optimistic. P-L had stood for over a century and—in their minds at least—the company was about as untouchable as one of its old growth redwoods. In the words of San Francisco Examiner reporter David Abramson:

“Far removed from the acoustically padded boardroom, where the company’s executives would wage their battle with the silent thrust and parry of weighty documents and legal precedents, the workers in Scotia were filled with confidence. ‘We’re going to win this battle,’ Mel Berti the butcher winked to all his customers. After all, most Scotians reasoned, Pacific Lumber had been through three major fires, two thunderous earthquakes, and floods that washed away a dancehall and most of their timber, and that hadn’t stopped them. Even the Great Depression only put a dent in the production line. ‘That first bid’s a joke,’ Randy Jeffers told his buddies on the road crew. ‘Pacific Lumber’s worth a whole lot more than that. Anyway, no one’s going to pop our bubble.’” [102]

In truth, however Elam had, at best, been saber rattling, because the Pacific Lumber board of directors was far more pragmatic than their loud proclamations would suggest at first blush. The lawsuit had been the first in a three prong strategy which also included protection of the company’s cash reserves (including the $50 million pension fund and surplus) in case the takeover succeeded in spite of their efforts, and—unbeknownst to the shareholders, workers, and their families—a “dignified” surrender. Elam had mobilized an army of advisors including Robert Hoover, the chairman of the board of Pacific Lumber, the prestigious law firm of Watchell, Lipton, Rosen, and Katz, and the investment bankers Saloman Brothers. Strangely, however, Roger Miller, representing the latter advised Elam that unless the board could secure a better tender offer, the majority of the shareholders would vote to sell out to Maxxam anyway. Should the board choose to fight the takeover, the stock prices would likely soon return to their initial price of $29 per share, which left the board open to shareholder lawsuits for not maximizing the value of their stock. One did not acquire the keys to the P-L kingdom without a shrewd—and sometimes dispassionate—business sense. [103] Hurwitz may have been reviled, even among his fellow capitalists, but he had done his homework. He knew that according to Pacific Lumber’s charter, the company was required to remain responsible not just to its finances but to the shareholders, employees, and its communities. [104] He countersued the P-L executives for trying to block his offer, charging that “the executives had breached their fiduciary duties by guaranteeing themselves a share of an estimated $60 million in surplus assets in the company retirement fund.” [105]

As a hedger, if Hurwitz couldn’t persuade the Pacific Lumber directors to go along with the plan, there were others who easily could. Roger Miller had warned Elam and Hoover to place little faith in the anti-merger protections that supposedly bulwarked the company from a takeover, stating that their legal standing was at best dubious. However this was only part of the story. [106] As it turned out Saloman Brothers were as motivated by greed as anyone and they had held several meetings with DBL through intermediaries and though both groups stood to gain whether the merger took place or not, according to their respective retainer agreements, both ultimately stood to gain more if the merger went through. The two groups had met prior to the tender offer and when it seemed the sale might be in danger of failing, they met again, privately, to strategize on how to make it succeed. After having devised their strategy, each met with their retainers. [107] Then, on Monday, October 21, Hurwitz and his DBL advisors met privately with Elam and his Saloman Brothers team. The Maxxam CEO increased his purchase offer to $39.30, and then again to $39.50. Elam refused both overtures, at which point Maxxam’s representatives prepared to leave and continue their hostile takeover attempts through other means, including further lawsuits if necessary. [108]

Hurwitz had one further ace up his sleeve in the person of P-L director Michael Coyne. Coyne had been brought into the Pacific Lumber fold and made a major shareholder when the company had acquired his welding and cutting business. Coyne was not a Hurwitz ally, but he stood to gain far more if the sale went through. He also broadcast his emotions quite openly and Hurwitz, being sly and cunning, was able to read him like an open book. Sensing that Elam as about to blink, the Maxxam CEO used a third party banker who knew Coyne personally to convince the latter to nudge Elam for one more round of negotiations. [109] The P-L president agreed, and Hurwitz upped his offer one last time to $40. The next day, Elam convened a meeting of the board of directors and presented the latest offer, and Miller once again counseled that $40 per share was the best likely offer they would receive. This time, the board took his advice. [110]

On Wednesday, October 23, 1985, the P-L directors announced that they had agreed to a merger with Maxxam. [111] In addition to the sale price, the board agreed to drop all litigation against Maxxam, stop pursuing any higher purchase offers, and to relinquish its hold on the pension fund. In turn, Hurwitz agreed to retain the current management, have Gene Elam be appointed to the new board of directors, and to maintain all existing employee benefits and compensation, but only for three years. [112] Hurwitz also agreed to defend the P-L board if the shareholders charged it with breaching their fiduciary duties. Officially this made the would-be hostile takeover into a friendly one. [113] In less than a month, Huwritz had managed to quite literally steal Pacific Lumber, a company worth $1.5 billion, for a mere $834 million. [114]

* * * * *

For the people of Scotia, the Pacific Lumber workers, their town, their houses, their entire existence for three generations, had just been sold out from under them. One anonymous P-L stockholder summed up the feelings of many by saying, “The company has been raided from the outside by a previously unknown corporate raider, and I’m under the distinct impression that some employees and large stockholders feel they have been raped thoroughly—but legally”. [115] Company foreman distributed bulletins announcing the merger. Long time employee, 49-year-old Fred Elliot recalled, “It felt like someone had died.” [116] Several Scotia residents and Pacific Lumber workers expressed their anger and dismay to reporters anonymously, in fear that they would be the first to go when the inevitable restructuring began. “Just last week they vowed to fight the takeover and even had a lawsuit against Maxxam …Why the sudden turnaround?” asked one. “I feel we’ve been sold down the tubes…and there’s not a damn thing we can do about it but wait and see what happens,” exclaimed another. [117]

Many of the employees were convinced that the Pacific Lumber board of directors had stabbed them in the back, all for the sake of lining their own pockets. To begin with, there were 34 executives, including Elam, who had stipulations in their personal contracts guaranteeing them “golden parachutes” of at least $100,000 each should the company be acquired in a merger. [118] Elam rebutted these accusations arguing that that the P-L directors had added the severance provision the previous year, well before Hurwitz had bought a single share of the company, precisely as a bulwark against a hostile takeover, because the six key administrators would be “expected to put up a bloody fight.” [119] However what he hadn’t revealed is that Hurwitz had agreed to increase these amounts in exchange for the directors’ silence.

Director Michael Coyne, had publically declared that Maxxam’s offer of $40 per share was the best the company had received, and he indicated that the board’s vote had been unanimous. [120] However, Coyne had personally benefitted from the sale, and he had not been a part of the extended Murphy “family” for very long. [121] Grover Wickersham, a San Francisco securities attorney and P-L shareholder of 20 years, disagreed with Coyne stating, “I think the board’s decision…was totally inconsistent with everything they have said previously to the shareholders. The course of action with the highest integrity would have been to present this action to the shareholders.” [122] Furthermore, Suzanne Murphy-Beaver contradicted Coyne declaring, “This was like duck soup (to Hurwitz). We all felt rushed but we (also) felt we had to be fair to the shareholders. Nobody on the board was in favor of this merger.” [123] Apparently many residents of Scotia agreed, and reportedly hung both Charles Hurwitz and Gene Elam in effigy outside one of the main buildings in Scotia. [124]

There were a few members of P-L’s extended family who apparently approved the change. For example, Stanley Parker, the former traffic manager at the company’s Scotia mill, and self appointed company historian, opined:

“I’m convinced company officials made a strong effort to find another buyer who would retain the company’s programs of looking to the future. They probably failed because there isn’t as much value in the company’s standing timber as you might think…I’m unhappy that the old management, many of which I’ve known personally for several years, is going. I have some company stock and I stand to make some money out of this, but I really don’t want to.” [125]

Parker’s assessment of the apparent decline in standing timber was based on old information however, because a visual cruise had not been conducted of the company’s complete holdings since 1956. [126] In his ill fated attempt to convince the old regime to embrace clearcutting, Robert Stephens had estimated P-L’s standing timber inventory to be approximately 5.2 bbf, and though this estimation was later dismissed as a poor assessment, it was more likely to have been a deliberate fabrication by Stephens and Campbell [127], even though it was accepted most as truthful. [128] Hurwitz himself had apparently suspected that Stephens’s figures had been off, because he had arranged for “surreptitious” flyovers through DBL, and quite possibly assessed that P-L had more standing timber than believed [129], a fact which was verified by an up-to-date timber cruise performed by the timber consulting firm Hammond, Jansen & Walling just after the takeover. [130]

Perhaps no one was more stunned by the announcement than Warren Murphy, and though he felt betrayed by the board, including his mother, this was but the beginning of the tragedy for him. He immediately sought out his friend John Campbell and expected his boss, the man who currently occupied the very office once used by his father and grandfather to join his fight; he could not have been more wrong. No sooner had the words left Warren’s mouth than Campbell took the wind out of his sails and informed him that since the board had made its decision, the matter was settled, and just to be clear, his supervisor repeated himself. This was effectively the end of their friendship, but if the younger Murphy had known the full truth, he would perhaps have been no less devastated. [131] Just weeks before Hurwitz had made himself known, William Bertain, of all people, had inadvertently clued Campbell in to the odd market fluctuations affecting P-L’s stock during a “Ducks Unlimited” benefit in Scotia. Privately sensing that new ownership might give him the opportunity he sought to increase P-L’s lumber harvesting, Campbell, (like Elam, Hoover, and Coyne) prepared to hedge his bets. [132]

Knowing that they faced an uphill battle, both Woody and Warren Murphy laid out their own strategy. Although he was no longer an employee, Woody Murphy was well liked by long time Pacific Lumber workers and their family members, and they looked to him for leadership. After several discussions the two brothers and their sister, Suzanne Murphy-Civian, retaining Bill Bertain as their counsel [133], filed a lawsuit on Wednesday, October 30, in San Francisco federal court charging that Hurwitz’s offer of $40 per share was less than the company’s long term worth. [134] Murphy-Civian declared, “To pay for the acquisition of Pacific Lumber, (Maxxam) will have to abandon the company’s historic sustained-yield policy and strip one of the world’s largest privately held stands of virgin redwoods.” Warren Murphy added, that the increased cutting rate likely to occur under the new regime would also cause timber prices on the North Coast to drop. [135] The three collectively owned three percent of P-L’s stock, and refused to sell their shares to Maxxam, [136] Woody Murphy justified the suit arguing that he and his fellow shareholders, who included no small percentage of the company’s employees, had been misled. “The stockholders are getting stampeded into a deal they aren’t fully aware of. The 80 percent rule was set up to prevent just what is happening—a hostile takeover,” he declared. [137]

Gene Elam, on the other hand—who had publically denounced Hurwitz one month previously—now sang a different tune, claiming that the deal was a good one for the P-L stockholders. He also dismissed the lawsuits as being groundless reminding everyone that the board, including Suzanne Beaver, the mother of the three Murphys, had voted unanimously to approve the sale. “It was a unanimous vote of all ten members—I was there…No one’s pointing that out, are they?” [138] Woody Murphy accused Elam of betrayal, suggesting that the reason for the latter’s turnaround was motivated purely by the aforementioned severance packages should Hurwitz dissolve the current board. Even though Hurwitz claimed he would not do this, his past practice suggested that the financier could not be trusted. Either way, Elam couldn’t deny that he had nothing to lose by throwing in his lot with the new regime. “His severance agreement is more than $193,000. He has a golden parachute, and it’s hard for him to be very objective in this kind of deal. He’s bought,” accused Woody Murphy angrily. [139]

Elam argued that Maxxam’s takeover would actually be a boon, declaring, “We don’t think employees have any reason to worry about their jobs. In order to service the (buyout) debt, there’s going to be more work, not less.” In the same instance, however, he uttered essentially contradictory statements saying, “In my opinion, it would be foolish for him to make changes in the present policies towards (P-L’s conservative cutting practices and paternalistic employee benefits). I’m counting on the fact and listen to what we have to say.” Elam offered no explanation on how Hurwitz was going to accomplish that in light of his increased cutting likely to be required in his debt servicing efforts. An anonymous fellow P-L director contradicted him, however, commenting, “Those [Maxxam] guys are going to go in and haul down all that redwood timber in about 10 minutes.” [140] Woody Murphy went a step further declaring, that given Hurwitz’s past dealings, he would likely not only destroy P-L, but the entire North Coast economy as well:

“The more timber you put on the market, the less valuable it becomes. It’ll hurt every mill on the coast…Hurwitz can guarantee that things will be great for three years and then, when he can’t service his debt, he can sell all (of the company’s) assets, close the mills, and leave with the money in his pocket. He’s not responsible to anyone but himself. We need someone who cares about the people in this area.” [141]

Elam responded, “Woody Murphy is incorrect on a lot of things.” [142] While that statement may have been true in a broad sense, it was not in this particular case. In Hurwitz’s 41 page document describing the specifics of his tender offer, which had yet to be made public, on page 18 there was clearly written proof that he considered at least doubling P-L’s lumber harvesting and selling off many of its assets, just as Woody Murphy had suggested. [143]

Elam, not content with merely defending his position, then tried to paint the Murphys and Bertain as malcontents. He declared that he had spoken with over 600 P-L employees during that week alone, and that in his estimation, he left them convinced that the sale was a positive development. [144] Murphy disagreed, stating, “I’ve had 15 to 20 calls a day and no one wants this. People feel they’ve been sold out. I got about a dozen calls just last night from people telling me they’re behind our suit 100 percent.” [145] Another unnamed employee, a company forester, confirmed this saying, “It’s a masterpiece of understatement to say we’re concerned. The things (Elam and the board) have done don’t really reassure anybody.” [146] As if to blunt any accusations that the Murphys were engaging in a coup, Woody disclosed that each of them stood to make at least $8 million on the sale of their approximately 600,000 shares apiece. Woody Murphy put it succinctly, “The money is a burdensome thing. I would have liked to keep the company going like it has for 117 years.” [147] The Murphy’s had been raised with the idea that Pacific Lumber was the proverbial “goose that lays the golden eggs,” and they were not about to participate in killing it.

* * * * *

None of these trivial matters concerned Charles Hurwitz, though. He was used to legal battles, as he had spent a good deal of his adult life involved in them. Very often he had the help of sympathetic, often arch-conservative judges. In the case of Pacific Lumber, none was more helpful to Charles Hurwitz than San Francisco Federal Court Justice William Schwarzer, an appointee of Hurwitz’a political ally, Gerald Ford. Time and again, he would issue decisions in favor of Maxxam. [148] Late on Friday, November 1, 1985, Schwarzer made his initial ruling in what would become an epic legal struggle. He dismissed the Murphy-Civiane lawsuit blocking the sale of the company to Maxxam and Hurwitz outright. [149] When the Murphys’ legal team requested access to DBL’s financial records, a standard discovery procedure in similar legal proceedings, Schwarzer refused. “You could have knocked us over with a feather,” recalled Woody Murphy ruefully. It was apparent that the judge had a bias. [150] Bertain would prove to be a tenacious opponent however, and appealed the decision to the Ninth Circuit Court in San Francisco within a week. [151]

At least one motivation of the Murphy lawsuit was to delay the sale of the company, and though the Murphys had experienced a setback, they were not the only aggrieved parties sharing that desire. There were at least two other lawsuits by different groups of shareholders still pending that were very similar in nature to the one filed by the Murphys. [152] Woody Murphy and his siblings could take solace in the fact that the other lawsuits were still hindering Hurwitz’s ability to raise the money to complete the purchase, which he was required to do by November 8. [153] Eureka attorney Clayton R Janssen filed a suit on behalf of shareholders Fred W. Slack, Janice Slack, and Marjorie Bussman alleging that the P-L board of directors had failed in its responsibility to consider the social, environmental, and economic impacts on the employees and the affected communities before accepting Hurwitz’s offer in violation of Article 10 of P-L’s Articles of Incorporation. [154]

That suit was joined by a third. Gene Elam had claimed that the board had attempted communication with 100 potential “white knights”, but apparently none had expressed interest in buying Pacific Lumber. [155] However, in a third lawsuit opposing the merger, plaintiffs charged Elam and his fellow directors with engaging in collusion with Maxxam arguing that, “Prior to the agreement, there was a tender offer made by a local company for $911 million ($42 per share), and Elam threw him out of the office. He wouldn’t even talk to him.” The P-L executive responded by claiming that the other buyer “didn’t want the liabilities,” which when deducted from the offer reduced the potential purchase price to between $35 and $36 per share. [156] San Francisco lawyer David Gold and Arcata attorney John Stokes filed the class action lawsuit on behalf of P-L stockholders William Fries and John Lippert calling for a temporary restraining order (TRO) against the merger in Humboldt County Superior Court. [157] Gold’s and Stokes’ arguments echoed those of Janssen’s, noting the board of directors’ initial rejection of Maxxam’s purchase offer followed by their sudden about face two weeks later. They also noted the irregularities in the initial stock purchases in which Ivan Boesky. Gold and Stokes also alleged that the directors had fast-tracked an increase in the severance packages of the aforementioned 34 executives in response to Hurwitz offer thus explaining their sudden reversal. [158]

Superior Court Justice John E. Buffington, in contrast with Schwarzer, did find merit in Gold’s and Stokes’ arguments and ruled in favor of the shareholders, issuing a TRO halting the sale until a preliminary hearing set for November 25. It also barred Maxxam from acquiring any additional stock until then. In his legal opinion, Buffington declared, “There is no denial of the fact the takeover company and the board reached certain agreements during negotiations and that there was a significant change in security benefits. In my opinion, the circumstances surrounding these changes and agreements need to be brought out.” Gene Elam seemed unimpressed with the ruling, however, declaring:

“I have the utmost confidence the board’s action will be found to be consistent with the high standards of integrity for which the Pacific Lumber Company has always been known. The board, when faced with a hostile takeover did everything it could to provide the most value possible to its shareholders and to protect the interests of all its employees. The charges against the board are without any merit whatsoever.” [159]

As was to be expected, Maxxam planned to appeal the ruling. [160] Woody Murphy, representing his two siblings as well as himself was elated, stating:

“I’m very pleased the court saw fit to issue a restraining order. I feel it’s a first step in saving Pacific Lumber from Maxxam…We’ve got a good chance, but we’re in the 12th hour and we need to get hold of the other stockholders and let them know there’s a group that’s trying to stop this takeover. I don’t care if they’ve got a million shares or only one…I want to talk to them.” [161]

The Murphys decided to use the added time to attempt a leveraged buyout of their own. Meanwhile, other opponents of the Maxxam takeover organized adjacent campaigns.

* * * * *

The resistance to Maxxam was joined on yet another, rather unexpected front. Many of the rank and file workers at Pacific Lumber—the one major timber company in northwestern California that had never recognized a union—were so fearful of losing their jobs, they sought help from the IWA. IWA Local #3-98 business agent Tim Skaggs publically revealed that the union had been meeting with several rank and filers in an unofficial capacity in order to determine the potential viability of an organizing campaign, in response to phone calls for help from several of the workers. The workers who sought union representation evidently hoped that presence of a legally recognized union bargaining unit might induce either Maxxam or the P-L board to back out of the sale, or at very least limit Maxxam’s ability to downsize the workforce. In the event that the latter did, a union contract could at least require that layoffs be conducted in order of seniority. Noting that P-L had been union free for much of its history, Skaggs urged potentially hesitant workers to consider that they were living in a whole new reality:

“The employees have to understand they can’t deal with management as individuals anymore, particularly if they find themselves with an owner who lives thousands of miles away and doesn’t know the lumber business. They’re going to have to deal with the company as a group with some power.” [162]

Maxxam responded with full page paid advertisements in various local publications, signed by Charles Hurwitz himself, addressed, “To the employees of the Pacific Lumber Company,” Stating:

“We were attracted to invest our money in Pacific Lumber largely because of its people and its tradition, history, and values. Each of you is very much a part of the great company that Pacific Lumber has become over the years. Your dedication and hard work have made it a fine company of which you should be very proud. I respect you for your efforts and I want you to know that I believe you are essential to Pacific Lumber’s continued success in the coming years. In fact, I believe that together we can make Pacific Lumber an even stronger company—serving the interests of its employees, customers, and communities.

“We want you to understand that we are committed to running Pacific Lumber as an operating company—now and in the future. We have a significant interest in your Company’s (sic) long term growth and development and we expect to be part of it for many, many years to come. We recognize your importance to our mutual success, and we have therefore taken steps to assure continuity for you and for the Company. We have agreed to continue all of the employee benefits and programs, as requested by your board of Directors…

“Your Board of Directors has unanimously approved our proposal.” [163]

This only angered the workers further. Pacific Lumber shipping clerk John Maurer of Carlotta, a ten year employee and fifteen year Humboldt County resident, who had served in Vietnam and later enrolled at College of the Redwoods in Eureka, earning a Bachelor’s degree in Business and Economics before signing on at the company, led this charge. After reading Hurwitz’s statement, he contacted Warren Murphy and informed the latter that he and his fellow workers wanted to help fight the takeover. Murphy, who realized that he couldn’t legally participate in any efforts to discredit Hurwitz due to his and his sibling’s efforts to engage in a leveraged buyout referred Maurer to Bill Bertain. The attorney advised Maurer to organize a petition drive to be published in the form of a protest letter as a paid advertisement in the local press. Maurer along with several others, including P-L millworker Charles “Kelly” Bettiga, blacksmith Clarence “Pete” Kayes, and monorail mechanic Lester Reynolds began circulating the petition at work on the morning of Friday, November 15.

As luck would have it, John Campbell was out of town, meeting with Elam in San Francisco, but he got word of the revolt through the word of an informant who contacted him. When the vice president heard of the efforts he immediately sent word to the frontline supervisors and foremen to shut it down. Some of the foremen responded instantly, but others—sympathetic to the petition—dragged their feet. Campbell then chartered a flight back to Humboldt County to quash the budding revolt, but it was already too late. By 11 AM, as many as 340 P-L workers, a whopping 40 percent of the company’s Humboldt County employees had signed the protest letter and very likely that number would have been larger had Maurer and his allies managed to expand their efforts beyond Scotia. Even as it was, the effort was unprecedented for the Pacific Lumber employees who had not participated in an employee revolt since 1946. [164] The ad, which ran on November 17, 1985, read:

“Some people are comfortable with the efforts of Charles Hurwitz and his Maxxam group to establish ownership of the Pacific Lumber Company. Most of us certainly are not! We, the employees who have signed this, do not feel that this impending takeover would be in the best interest of ourselves, the shareholders, and the communities in which our company serves. Most of us are the hardworking individuals who feel that PALCO was an honorable, well-serving company, with a heritage that we could be proud of—not only a secure place to work, but one which dealt conscientiously with the preservation and proper management of our vital resources: our people and the redwoods.

“In all earnestness, we do not feel that a company of real estate investors from the east coast can manage resources such as ours with the consideration that has been shown all these years by the Murphy Family. We wish to protect the integrity of our company, which has served our community so well…It is our sincere belief that if the company’s leadership were back in the hands of the Murphy Family, the company’s business, our environment, and the communities in which we all live will continue to prosper…” [165]

* * * * *

Still others joined the fight. The resistance to Maxxam’s takeover also drew the support of environmentalists. The Humboldt Greens expressed their support for the stunned P-L workers and shareholders. A meeting held in Garberville, on October 28, 1985 drew organizers from Fortuna to Briceland. Those attending unanimously rejected the takeover and called to a return to the original ownership. They pledged to ally themselves with the efforts of the P-L stockholders to block the takeover as well as the workers and townspeople. [166] Tim McKay of the Northcoast Environmental Center (NEC) in Arcata stated,

“There is a lot of apprehension here. They (were) the most stable lumber company in our region and they are about to go into liquidation-of-assets mode. It may be the last boom in the boom-and-bust history of Humboldt County. That Maxxam would do this was evident in their takeover offer. They would need funds ‘substantially in excess’ of Pacific Lumber’s then-current profits to pay off the purchase debt, and were thus ‘considering selling P-L’s cutting and welding subsidiary and increasing the company’s annual lumber production.’” [167]

On November 9, 1985, the NEC joined in the legal fight against Maxxam, petitioning the Securities and Exchange Commission (SEC) to withhold any action on the takeover until Maxxam completed an environmental impact statement (EIS) as required under the National Environmental Policy Act. “Such a major shift in policy from P-L’s tradition of sustained-yield forestry could lead to increased sedimentation in the Eel River and more economic troubles for a region already suffering from high unemployment,” declared McKay. [168]

Even local business interests worried about the potential economic troubles that might result from the Maxxam takeover. Henry Smith & Co. analyst Alan Tate pointed out that even simply boosting the lumber output might be insufficient to answer all of Maxxam’s debt obligations, and further echoed the concerns about depressing the local market with a glut of lumber. Added to that, the loss of support from increasingly vocal environmentalists could further hurt the company’s economic standing. [169] Kent Driesbock, director of the Eureka Economic Development Corporation admonished the Humboldt County business community to take steps to mitigate the impact of the potential changes that might result from the merger, including especially the diversification of the local economy—no easy task in a county that was still very heavily dependent upon timber. He also warned it would take time to absorb the impact of displaced workers. The county had already endured several layoffs, as well as the union busting labor dispute at Louisiana Pacific, and conditions at Simpson Timber were not appreciably better. [170]

The public at large was also largely vocal on the merger, and expressed their opinions in the editorial pages of the local press. Without exception every letter opposed the Maxxam takeover. The most articulate example was penned by David Simpson, speaking on behalf of the students and faculty at Petrolia High School. [171] Many, such as Bill Barton [172] and F Carmichael [173], feared that Hurwitz would engage in slash and burn logging in stark contrast with the old Pacific Lumber’s sustainable forestry practices. Scotia resident Carol J. Fielder, whose husband had been an employee of P-L editorialized in favor of the Murphys and against Hurwitz. [174]

Even the local press itself was divided on the merger. Naturally the environmental publications opposed it. By contrast, the Humboldt Beacon and Fortuna Advance, whose political orientation was staunchly right wing, editorialized in favor of the sale opining, “If not Maxxam, somebody else. That’s what many say. It is obvious that in 1985, the Pacific Lumber Company has become ripe for sale, merger, or a merged-sale…Change is often painful, but necessary, for progress.” [175] Bruce Lang, news director at KIEM-TV in Eureka had a more neutral take, declaring, “Some people are worried, but some sort of like it. Pacific Lumber has been sort of a deity up here. Now, it will be down there with the rest of us.” [176] The Eureka Times-Standard, on the other hand, in spite of its conservative political orientation editorialized against the takeover declaring:

“We’ve got trouble. Right here in timber city. With a capital ‘T’, and that rhymes with ‘P’, and that stands for power play…

“(Maxxam’s) ‘quick profit’ policy can play unhealthy dividends to a community which has thrived on the timber industry for over a hundred years…

“Those who own P-L stock should think twice before selling off their shares…” [177]

As the dissent grew, the battle to thwart Hurwitz and Maxxam continued. On November 8, 1985, Suzanne Beaver resigned from the Pacific Lumber board of directors in order to join her children in their fight. “She realized (that) she was in an awkward position in this whole affair. She wanted to be on our side, but she couldn’t do that if she stayed on the board,” declared Warren Murphy. [178]

The revolt seemed to be gaining momentum, until, on November 12, Maxxam representatives revealed that Hurwitz had purchased 13 million shares of P-L’s common stock, approximately 60 percent of the total, prior to Buffington’s restraining order, thus giving Hurwitz a total of almost 65 percent overall. The corporate raider announced that he was prepared to purchase the remainder of the common stock if the appeal was lifted; Hurwitz needed 80 percent in order to complete his takeover. [179] However a three judge panel of the First District Court of Appeals in San Francisco denied requests by both Maxxam and the P-L board of directors to overturn the TRO. Gold, Stokes, and Bob Janssen (who was still representing Slack, Slack, and Bussman) were elated. [180]

Their triumph was short lived, however, because two days later, Maxxam filed a countersuit in the San Francisco Court of appeals charging that Buffington’s court lacked jurisdiction on the matter. The suit named judge Buffington and the two stockholders, Fries and Lippert, whose suit brought about the TRO as defendants. [181] The following week, Judge William Schwarzer again dashed the hopes of Maxxam’s adversaries, finding in favor of Hurwitz’s challenge to Buffington’s jurisdiction. [182] Gold and Slack appealed the decision, but the 9th Circuit Court affirmed Schwarzer’s ruling, though the court also allowed the appellants to appeal the decision again, which they did to the US Supreme Court. [183] The defendants seemed confident that the courts would eventually brush aside the legal challenges against them. Seemingly unconcerned with the unpredictable outcome of the legal battle, the P-L board of directors proceeded with plans to construct a 25 megawatt cogeneration plant in Scotia. P-L public affairs manager David Galitz signaled his support for the new regime, declaring that Hurwitz supported the construction of the facility, as indicative of the corporate raider’s intentions not to sell off P-L’s assets. [184] Those with more to lose, however, were taking no chances.